Broomfield Car Sales Tax . Colorado state sales/use tax is 2.9%; Web the 8.6% sales tax rate in broomfield consists of 2.9% colorado state sales tax, 0.75% broomfield county sales tax, 3.85%. Web the current sales tax in colorado is 2.9%. Look up 2024 sales tax rates for broomfield, colorado, and surrounding. Web the sales tax rate in broomfield is 8.15%, and consists of 2.9% colorado state sales tax, 4.15% broomfield city tax and 1.1%. Rtd sales/use tax is 1.1%;. The december 2020 total local sales tax rate. Web sales taxes are based on the vehicle purchase price. Web the current total local sales tax rate in broomfield, co is 7.150%. Web the total sales tax rate for the city and county of broomfield (excluding special districts) is 8.15%. It's important to note, this does not include any local or county sales. Web the total sales tax rate for the city and county of broomfield ( excluding special districts) = 8.15%.

from www.templateroller.com

Look up 2024 sales tax rates for broomfield, colorado, and surrounding. The december 2020 total local sales tax rate. It's important to note, this does not include any local or county sales. Web the total sales tax rate for the city and county of broomfield ( excluding special districts) = 8.15%. Web the total sales tax rate for the city and county of broomfield (excluding special districts) is 8.15%. Web the sales tax rate in broomfield is 8.15%, and consists of 2.9% colorado state sales tax, 4.15% broomfield city tax and 1.1%. Web sales taxes are based on the vehicle purchase price. Web the current sales tax in colorado is 2.9%. Rtd sales/use tax is 1.1%;. Colorado state sales/use tax is 2.9%;

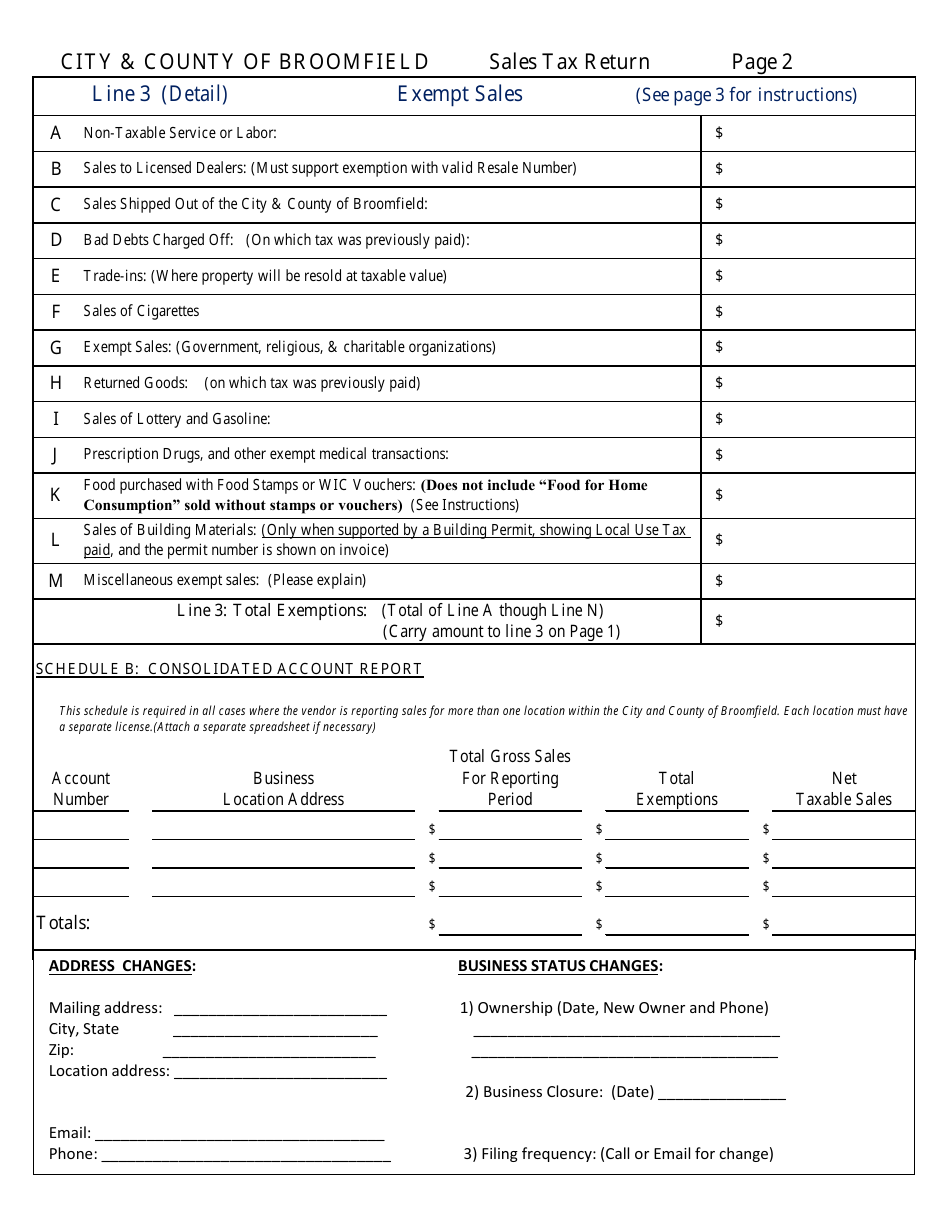

City and County of Broomfield, Colorado Sales Tax Return Form Fill

Broomfield Car Sales Tax It's important to note, this does not include any local or county sales. Look up 2024 sales tax rates for broomfield, colorado, and surrounding. Web the total sales tax rate for the city and county of broomfield ( excluding special districts) = 8.15%. The december 2020 total local sales tax rate. Web the 8.6% sales tax rate in broomfield consists of 2.9% colorado state sales tax, 0.75% broomfield county sales tax, 3.85%. Web the total sales tax rate for the city and county of broomfield (excluding special districts) is 8.15%. Web the current sales tax in colorado is 2.9%. It's important to note, this does not include any local or county sales. Colorado state sales/use tax is 2.9%; Rtd sales/use tax is 1.1%;. Web sales taxes are based on the vehicle purchase price. Web the sales tax rate in broomfield is 8.15%, and consists of 2.9% colorado state sales tax, 4.15% broomfield city tax and 1.1%. Web the current total local sales tax rate in broomfield, co is 7.150%.

From www.pinterest.com

Used Car Sale Receipt Templates at Resumé Broomfield Car Sales Tax Web the current sales tax in colorado is 2.9%. Web the current total local sales tax rate in broomfield, co is 7.150%. Web the total sales tax rate for the city and county of broomfield ( excluding special districts) = 8.15%. Web sales taxes are based on the vehicle purchase price. Colorado state sales/use tax is 2.9%; Web the 8.6%. Broomfield Car Sales Tax.

From www.formsbank.com

Sales Tax License Application City And County Of Broomfield printable Broomfield Car Sales Tax Web the current sales tax in colorado is 2.9%. Web the total sales tax rate for the city and county of broomfield (excluding special districts) is 8.15%. Web the total sales tax rate for the city and county of broomfield ( excluding special districts) = 8.15%. The december 2020 total local sales tax rate. It's important to note, this does. Broomfield Car Sales Tax.

From www.formsbank.com

Sales Tax Return City & County Of Broomfield Sales Tax Administration Broomfield Car Sales Tax Rtd sales/use tax is 1.1%;. Colorado state sales/use tax is 2.9%; Web sales taxes are based on the vehicle purchase price. It's important to note, this does not include any local or county sales. Web the sales tax rate in broomfield is 8.15%, and consists of 2.9% colorado state sales tax, 4.15% broomfield city tax and 1.1%. The december 2020. Broomfield Car Sales Tax.

From ar.inspiredpencil.com

Car Wash Receipt Template Broomfield Car Sales Tax Colorado state sales/use tax is 2.9%; Web the 8.6% sales tax rate in broomfield consists of 2.9% colorado state sales tax, 0.75% broomfield county sales tax, 3.85%. Web the sales tax rate in broomfield is 8.15%, and consists of 2.9% colorado state sales tax, 4.15% broomfield city tax and 1.1%. Web the total sales tax rate for the city and. Broomfield Car Sales Tax.

From www.srbbroomfield.org

Broomfield Days Car Show SRB Annual Fundraiser Event Broomfield Car Sales Tax The december 2020 total local sales tax rate. Web the 8.6% sales tax rate in broomfield consists of 2.9% colorado state sales tax, 0.75% broomfield county sales tax, 3.85%. Web the sales tax rate in broomfield is 8.15%, and consists of 2.9% colorado state sales tax, 4.15% broomfield city tax and 1.1%. Web the total sales tax rate for the. Broomfield Car Sales Tax.

From keriykatherina.pages.dev

State Of Ohio Sales Tax Rates 2024 Olympics Lian Sheena Broomfield Car Sales Tax Web the current total local sales tax rate in broomfield, co is 7.150%. Web the total sales tax rate for the city and county of broomfield (excluding special districts) is 8.15%. The december 2020 total local sales tax rate. Web the 8.6% sales tax rate in broomfield consists of 2.9% colorado state sales tax, 0.75% broomfield county sales tax, 3.85%.. Broomfield Car Sales Tax.

From www.templateroller.com

City and County of Broomfield, Colorado Vehicle Bill of Sale Fill Out Broomfield Car Sales Tax Web the sales tax rate in broomfield is 8.15%, and consists of 2.9% colorado state sales tax, 4.15% broomfield city tax and 1.1%. The december 2020 total local sales tax rate. Web the current total local sales tax rate in broomfield, co is 7.150%. Web the current sales tax in colorado is 2.9%. It's important to note, this does not. Broomfield Car Sales Tax.

From www.templateroller.com

City and County of Broomfield, Colorado Sales Tax Return Form Fill Broomfield Car Sales Tax Web the 8.6% sales tax rate in broomfield consists of 2.9% colorado state sales tax, 0.75% broomfield county sales tax, 3.85%. Rtd sales/use tax is 1.1%;. Web the total sales tax rate for the city and county of broomfield (excluding special districts) is 8.15%. The december 2020 total local sales tax rate. Web the current sales tax in colorado is. Broomfield Car Sales Tax.

From www.srbbroomfield.org

Broomfield Days Car Show SRB Annual Fundraiser Event Broomfield Car Sales Tax Look up 2024 sales tax rates for broomfield, colorado, and surrounding. Web the total sales tax rate for the city and county of broomfield ( excluding special districts) = 8.15%. Colorado state sales/use tax is 2.9%; Web the current sales tax in colorado is 2.9%. Rtd sales/use tax is 1.1%;. Web the current total local sales tax rate in broomfield,. Broomfield Car Sales Tax.

From marcon-construction.co.uk

Broomfield Car Park Marcon Construction Ltd Broomfield Car Sales Tax Rtd sales/use tax is 1.1%;. Web the total sales tax rate for the city and county of broomfield (excluding special districts) is 8.15%. Colorado state sales/use tax is 2.9%; The december 2020 total local sales tax rate. Web the current total local sales tax rate in broomfield, co is 7.150%. Web the 8.6% sales tax rate in broomfield consists of. Broomfield Car Sales Tax.

From www.formsbank.com

Sales Tax License Application Form City And County Of Broomfield Broomfield Car Sales Tax Rtd sales/use tax is 1.1%;. Web the total sales tax rate for the city and county of broomfield (excluding special districts) is 8.15%. Web the 8.6% sales tax rate in broomfield consists of 2.9% colorado state sales tax, 0.75% broomfield county sales tax, 3.85%. Web sales taxes are based on the vehicle purchase price. Web the current sales tax in. Broomfield Car Sales Tax.

From www.srbbroomfield.org

Broomfield Days Car Show SRB Annual Fundraiser Event Broomfield Car Sales Tax Web the current total local sales tax rate in broomfield, co is 7.150%. Web the 8.6% sales tax rate in broomfield consists of 2.9% colorado state sales tax, 0.75% broomfield county sales tax, 3.85%. Web the total sales tax rate for the city and county of broomfield (excluding special districts) is 8.15%. It's important to note, this does not include. Broomfield Car Sales Tax.

From scenearchitects.co.uk

Broomfield Hospital Multistorey car park Scene Broomfield Car Sales Tax Web the sales tax rate in broomfield is 8.15%, and consists of 2.9% colorado state sales tax, 4.15% broomfield city tax and 1.1%. Web the total sales tax rate for the city and county of broomfield (excluding special districts) is 8.15%. Web the current sales tax in colorado is 2.9%. Web sales taxes are based on the vehicle purchase price.. Broomfield Car Sales Tax.

From www.formsbank.com

Sales Tax License Application Form City And County Of Broomfield Broomfield Car Sales Tax Web sales taxes are based on the vehicle purchase price. Web the sales tax rate in broomfield is 8.15%, and consists of 2.9% colorado state sales tax, 4.15% broomfield city tax and 1.1%. Look up 2024 sales tax rates for broomfield, colorado, and surrounding. The december 2020 total local sales tax rate. Web the current total local sales tax rate. Broomfield Car Sales Tax.

From privateauto.com

How Much are Used Car Sales Taxes in Alabama? Broomfield Car Sales Tax Look up 2024 sales tax rates for broomfield, colorado, and surrounding. Web the sales tax rate in broomfield is 8.15%, and consists of 2.9% colorado state sales tax, 4.15% broomfield city tax and 1.1%. Web the 8.6% sales tax rate in broomfield consists of 2.9% colorado state sales tax, 0.75% broomfield county sales tax, 3.85%. Web sales taxes are based. Broomfield Car Sales Tax.

From www.broomfield.org

Car Show City and County of Broomfield Official Website Broomfield Car Sales Tax It's important to note, this does not include any local or county sales. Web the 8.6% sales tax rate in broomfield consists of 2.9% colorado state sales tax, 0.75% broomfield county sales tax, 3.85%. Rtd sales/use tax is 1.1%;. Web the sales tax rate in broomfield is 8.15%, and consists of 2.9% colorado state sales tax, 4.15% broomfield city tax. Broomfield Car Sales Tax.

From www.formsbank.com

Refund Claim For Sales Tax Paid Form City And County Of Broomfield Broomfield Car Sales Tax Look up 2024 sales tax rates for broomfield, colorado, and surrounding. Web the total sales tax rate for the city and county of broomfield (excluding special districts) is 8.15%. Web the 8.6% sales tax rate in broomfield consists of 2.9% colorado state sales tax, 0.75% broomfield county sales tax, 3.85%. Web the sales tax rate in broomfield is 8.15%, and. Broomfield Car Sales Tax.

From www.youtube.com

Tax Accountant Broomfield Co For Tax Preparation And Tax Return Broomfield Car Sales Tax Look up 2024 sales tax rates for broomfield, colorado, and surrounding. The december 2020 total local sales tax rate. Rtd sales/use tax is 1.1%;. Web the total sales tax rate for the city and county of broomfield (excluding special districts) is 8.15%. Web the current sales tax in colorado is 2.9%. It's important to note, this does not include any. Broomfield Car Sales Tax.